Hawkins attorneys have a thorough understanding of the many financing structures utilized in the mass transit industry. For decades, the firm’s transportation team has counselled many of the largest mass transit systems in the nation.

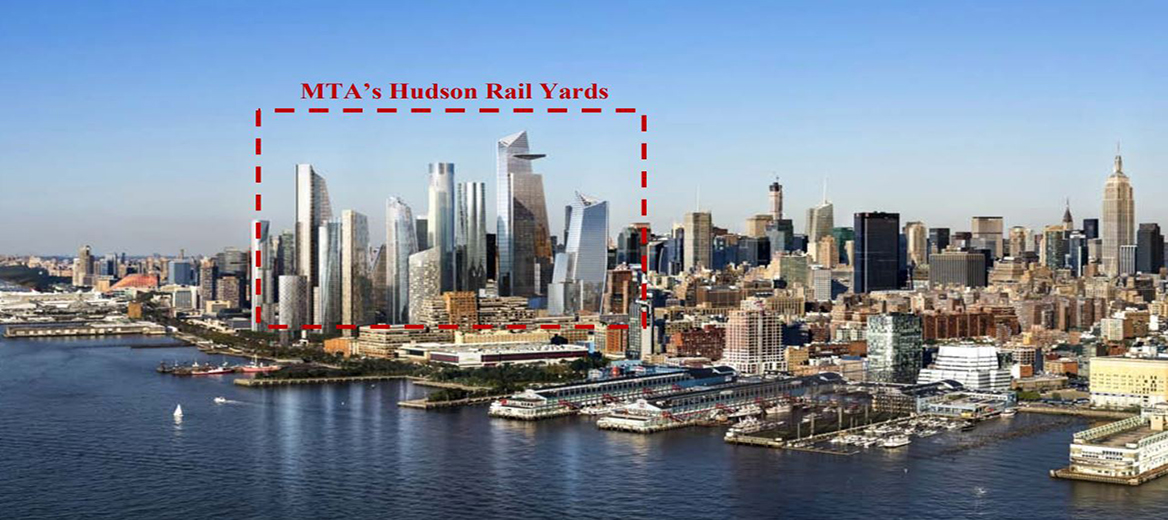

Hawkins has significant experience working as bond counsel, disclosure counsel and underwriters’ counsel on mass transit financings and representing major transit authorities throughout the country, including New York MTA and Washington Metropolitan Area Transit Authority. The firm worked with the New York MTA as bond counsel in the successful implementation of the complex and largest restructuring of municipal debt ever effected in the United States, involving (i) the issuance of 29 series of refunding bonds aggregating over $17.3 billion under four newly created and far more flexible credit structures and (ii) the refunding and defeasance of 17 distinct MTA credits comprising 87 series of refunded bonds.

Our experience on these financings allows us to anticipate any unique diligence and legal issues that might arise in mass transit financings and quickly and effectively guide our clients to a successful financial closing.

In each of our TIFIA loan projects, we work closely with United States Department of Transportation in developing a thorough understanding of the proposed project being financed, identifying issues in need of resolution through a detailed due diligence memorandum. We also carefully review the borrower’s state statutes authorizing the pledge of its revenues for repayment of the TIFIA loans.

Hawkins has served as lender’s counsel to TIFIA on several mass transit facility loans. These include projects for:

- Washington Metro Area Transit Authority (Washington, DC)

- Tren Urbano (Puerto Rico)

- Reno, Nevada (Trac Multi-Modal Project)

- Los Angeles County Metropolitan Transportation Authority (Crenshaw/LAX Line)

The firm brought to successful financial close three TIFIA loans to the Chicago Transit Authority for critically needed projects: the 95th Street terminal improvement, the rail fleet replacement, and the new 24-hour rapid transit train blue line connecting Chicago-O'Hare International Airport to Forest Park terminal, via downtown Chicago. In connection with these loans, we helped structure the gross revenue pledge of transit revenue based on experience gained from New York MTA’s $17 billion mass transit credit restructuring.

The following is a representative list of the firm’s recurring bond counsel and underwriters’ counsel engagements in the mass transit sector:

- Los Angeles County Metropolitan Transportation Authority

- Maine Municipal Bond Bank

- Metropolitan Transportation Authority, New York

- Portland City, Oregon

- San Francisco Municipal Transportation Agency

- State of Oregon

- Tri-County Metropolitan Transportation District

- Washington Metropolitan Area Transit Authority